In November 2020 we covered industry analyst Edahn Golan’s prediction that the rising trajectory of jewelry sales and consumer demand for “more but lasting” items during the pandemic forecast a very positive US holiday season for jewelry. Those predictions were entirely correct, as consumers splurged on luxury goods and bridal items, stimulating holiday sales.

After analyzing trends in 2021, Mr. Golan has again forecast a booming holiday season for jewelers.

A 2021 Upswing

According to Golan:

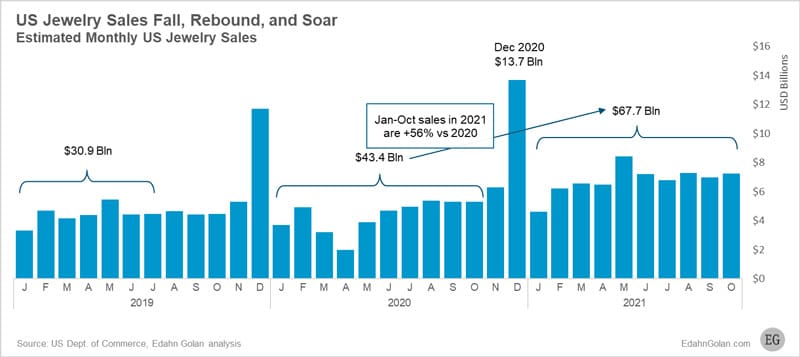

After a roller coaster 2020, 2021 continued the upswing in jewelry sales to a degree few if any expected. Sales in October rose 37%, and we expect holiday jewelry sales to top that and close a fantastic year for the industry. In October, US jewelry sales reached an estimated $7.3 billion, a record for the month, based on US Department of Commerce data.

Year to date, US jewelry sales have totaled $67.8 billion. For a perspective on how unusual these sales levels are, consider the following: sales in the first ten months of 2021 alone have already surpassed 2020’s record sales of $62.3 billion by 9%.

Further, year over year, the value of jewelry sales in 2021 are 37% percent higher than those in the first ten months of 2020. Compared to 2019, a “normal” year, sales are up 2%.

“Not Regular Years”

Golan further notes that 2020 and 2021 were not regular years economically, socially, or medically:

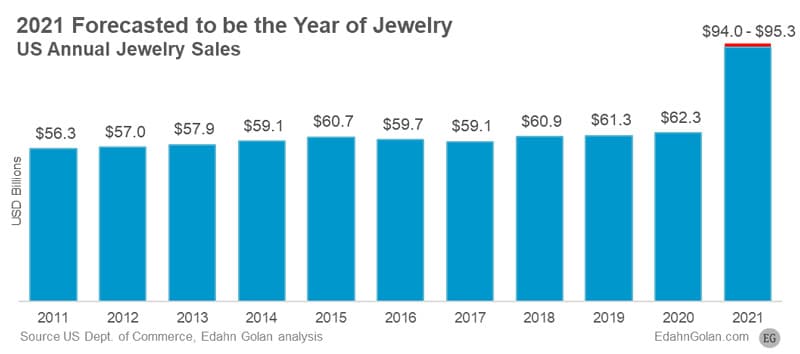

By now, it is clear that the COVID lockdowns, temporary store closures, drop in travel, and the deep dip in related consumer expenditures did wonders for jewelry demand. On an annualized basis, 2021 jewelry sales stand at $101.1 billion, up 62% over the $62.3 billion in jewelry sales in 2020. Based on our analysis, the gap between the two figures will shrink by year’s end. Jewelry analytics show that in October in a regular year, annualized sales are 1.6% higher than final year figures.

Based on our US market jewelry analysis, we should expect US jewelry sales to total $94 to $95.3 billion, up 51% to 53% year over year. Our 2021 US holiday jewelry sales prediction is a rise of 40-42% in the November-December holiday period.

Gold and Diamond Dynamics

The fluctuating price of gold, which declined last year, may have helped jewelry sales by allowing for increased demand while costing less. Meanwhile, diamond prices increased while supply chains were impacted by COVID. As Golan notes:

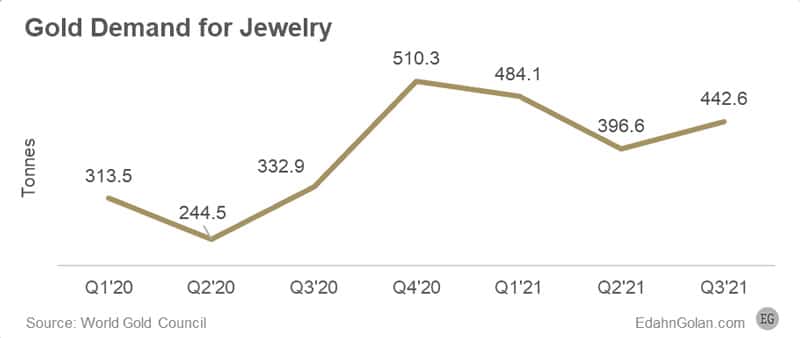

This rise in demand not only pushed up jewelry sales, but there was also an interplay with gold and diamonds. Global gold demand for jewelry increased 41% by volume since the first quarter of 2020. Jewelry demand for gold tends to rise in Q4, and with current holiday jewelry sales moving fast, gold demand is expected to keep rising.

The price of gold fluctuated during the period. In the past year, it declined 6%, according to the World Gold Council. This decline may have helped jewelry sales, allowing for increased demand against lessening costs.

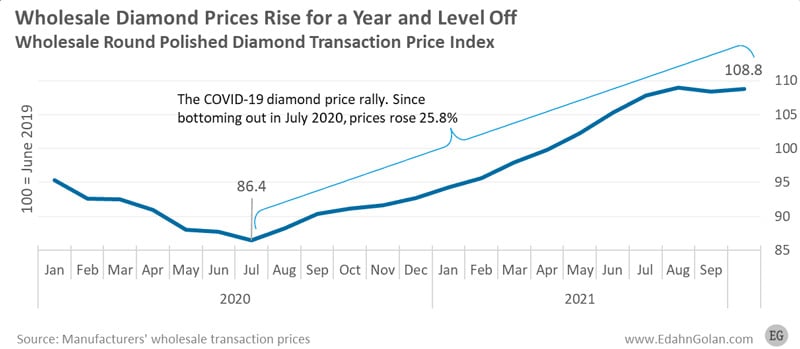

Diamonds played a completely different, almost mirror-image role. First, it was diamonds that were affected by jewelry sales, not the other way around. Once demand picked up, and wholesale inventories shrank, polished diamond prices started to soar.

It seems, however, that the strong appetite of the diamond industry midstream – the manufacturers – has now outpaced consumer demand. Currently, polished diamond prices have leveled off, yet remain high.

The Bottom Line

Golan’s summary:

A fantastic holiday jewelry sales season is underway. Expect sales to rise a strong double-digit year over year. A successful holiday season results in a rush for goods in January. We predict continued high demand for jewelry and diamonds in early 2022.

Learn more about Edahn Golan at www.edahngolan.com.

https://www.igi.org.cn/gemblog/jewelry-sales-super-since-september/

*

Industry analyst Edahn Golan takes an in-depth look at US jewelry sales trends and sees a lot of indications it is going to be a terrific holiday season.

Reprinted courtesy www.edahngolan.com.

After a roller coaster 2020, 2021 continued the upswing in jewelry sales to a degree few if any expected. Sales in October rose 37%, and we expect holiday jewelry sales to top that and close a fantastic year for the industry.

In October, US jewelry sales reached an estimated $7.3 billion, a record for the month, based on US Department of Commerce data.

Year to date, US jewelry sales have totaled $67.8 billion. For a perspective on how unusual these sales levels are, consider the following: sales in the first ten months of 2021 alone have already surpassed 2020’s record sales of $62.3 billion by 9%.

Further, year over year, the value of jewelry sales in 2021 are 37% percent higher than those in the first ten months of 2020. Compared to 2019, a “normal” year, sales are up 2%.

Click here to open the US Jewelry Sales 2019-2021 graph

Holiday Jewelry Sales

By now, it is clear that the COVID lockdowns, temporary store closures, drop in travel, and the deep dip in related consumer expenditures did wonders for jewelry demand.

On an annualized basis, 2021 jewelry sales stand at $101.1 billion, up 62% over the $62.3 billion in jewelry sales in 2020.

Based on our analysis, the gap between the two figures will shrink by year’s end. Jewelry analytics show that in October in a regular year, annualized sales are 1.6% higher than final year figures.

But 2020 and 2021 were not regular years economically, socially, or medically.

Based on our US market jewelry analysis, we should expect US jewelry sales to total $94 to $95.3 billion, up 51% to 53% year over year.

Our 2021 US holiday jewelry sales prediction is a rise of 40-42% in the November-December holiday period.

Click here to open the graph “2021 Forecasted to be the Year of Jewelry”

Lower Price of Gold Helps Holiday Jewelry Sales

This rise in demand not only pushed up jewelry sales, but there was also an interplay with gold and diamonds.

Global gold demand for jewelry increased 41% by volume since the first quarter of 2020. Jewelry demand for gold tends to rise in Q4, and with current holiday jewelry sales moving fast, gold demand is expected to keep rising.

The price of gold fluctuated during the period. In the past year, it declined 6%, according to the World Gold Council. This decline may have helped jewelry sales, allowing for increased demand against lessening costs.

Click here to open the graph “Gold Demand for Jewelry”

Diamonds Lifted by Jewelry Demand

Diamonds played a completely different, almost mirror-image role. First, it was diamonds that were affected by jewelry sales, not the other way around. Once demand picked up, and wholesale inventories shrank, polished diamond prices started to soar.

It seems, however, that the strong appetite of the diamond industry midstream – the manufacturers – has now outpaced consumer demand. Currently, polished diamond prices have leveled off, yet remain high.

Click here to open the graph “Wholesale Diamond Prices”

The Bottom Line

A fantastic holiday jewelry sales season is underway. Expect sales to rise a strong double-digit year over year. A successful holiday season results in a rush for goods in January. We predict continued high demand for jewelry and diamonds in early 2022.

Edahn Golan has 20 years of experience as a diamond industry analyst. He has a unique ability to provide a global view with context to the exclusive granular data he shares. The New York Times, Wall Street Journal, Business Insider, and other leading publications quote him regularly.