The pilot program launched last year.

In October 2019 Alrosa, the world leader in diamond mining, teamed up with Sarine Technologies to provide digital-scans, assessments and calculated polishing solutions for rough diamonds to their customers. This was originally intended to facilitate analysis and pre-selection of choices prior to a traditional rough “tender” – an auction where bids for rough-parcels are submitted in writing, to be tallied at the end of a live examination period.

In 2020 there was dramatic change as the world entered quarantine. Diamond mining came to a halt. Rough was still available for sale, but trading centers were unable to host traditional onsite, physical tenders. As a result, industry giant De Beers’ completely canceled their March tender (aka sight) entirely.

Exploring new territory

The global situation caused Alrosa to rethink their own March auction of special-sizes. “Specials” are larger rough diamonds weighing over 10.8 carats apiece. These crystals are offered for sale one by one, as opposed to smaller rough which is traditionally packaged and sold in parcels. Instead of canceling those sales, Alrosa broke new digital ground. The larger-crystals were instead offered at a digital tender. Evgeny Agureev, Deputy CEO of ALROSA explained the decision in a March press release:

Health of our employees and customers is essential for us. This is why we decided to cancel upcoming auctions and shorten those already in progress. The company is in contact with customers from different countries, considering different supporting measures. One of the opportunities is a digital tender. It will not replace the traditional trading model, but becomes a solution for those who are ready to work remotely right now. From our part, we will provide all the necessary information about our rough diamonds and will negotiate with customers on payment terms and logistics.

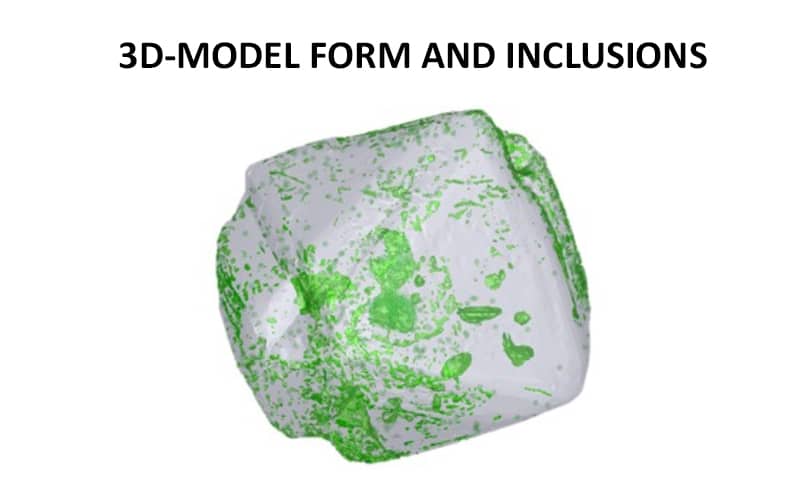

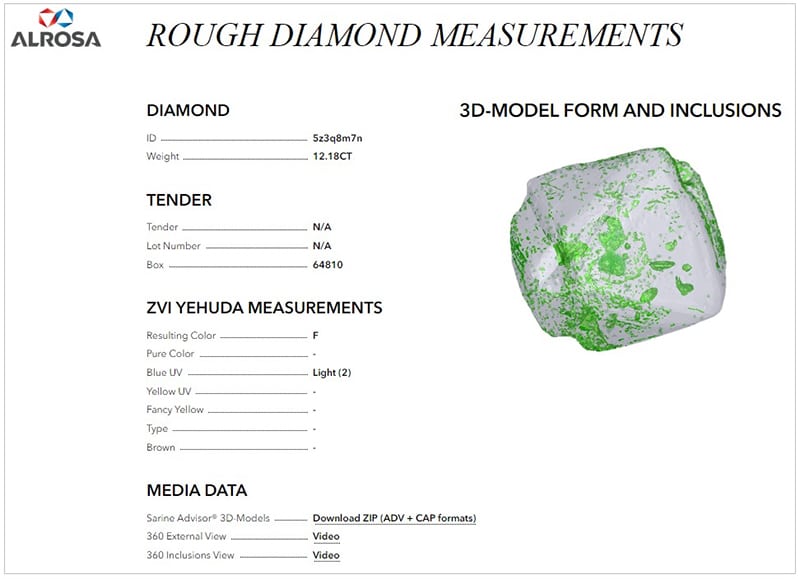

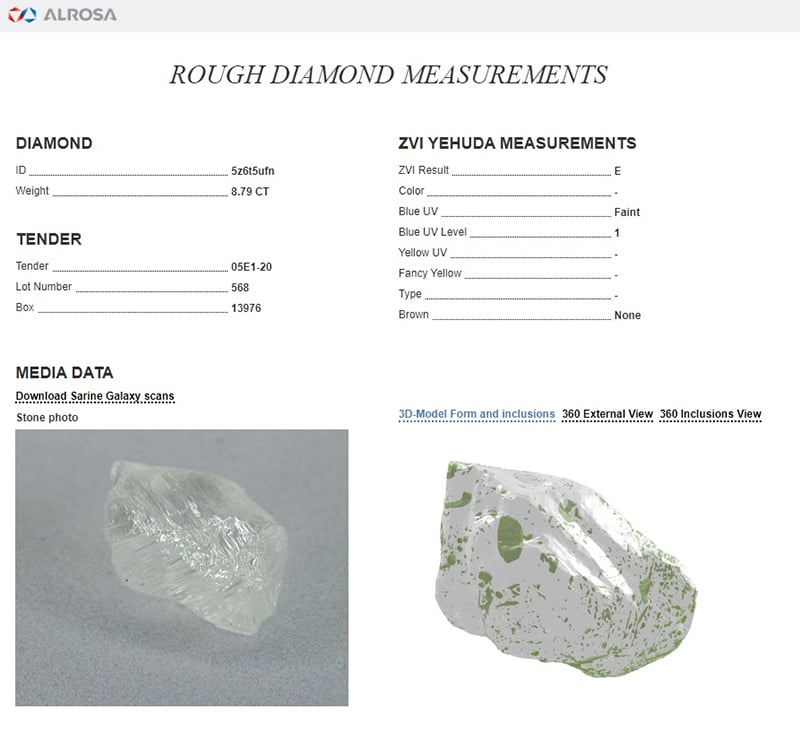

Alrosa provided online imagery and data to customers, including a 3D model of each special generated from scans, mapping the crystal’s external shape and internal inclusions. 360 degree spin-videos of both external and internal features were posted, along with details regarding color and fluorescence.

Downloadable 3D models of each rough crystal could also be opened in Sarine Advisor software. This technology can assist diamond producers in calculating and planning the polished output of a rough diamond according to priorities, yield preferences and price considerations.

May the rough be with you

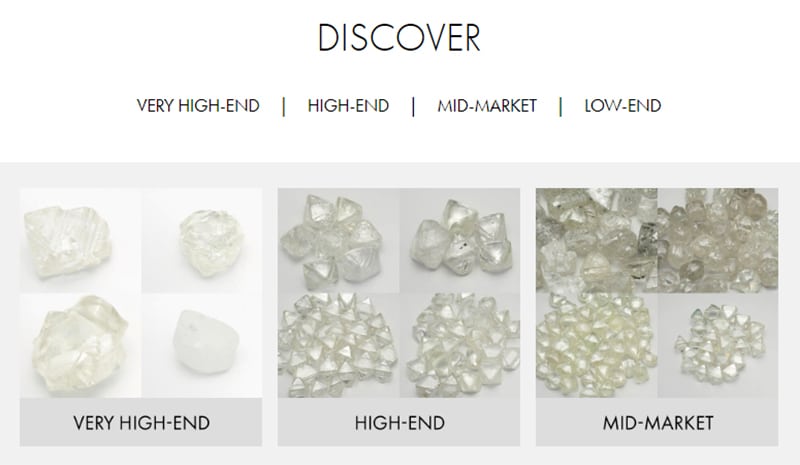

At the end of May Alrosa took a larger digital step forward, offering over 800 rough diamonds in the 5.00 to 10.00 carat range to long-term customers, again via digital tender. This was the largest volume the company had ever posted online. Here again, the digital tender conveyed detailed information on individual crystals – even though these weights are normally sold in parcels of multiple stones. This facilitated thorough assessment, planning and cherry-picking by customers.

As Agureev reported:

After analyzing the clients’ needs, the company for the first time puts such vast amount of diamonds up for a digital tender. We consciously decided to sell stones separately, allowing clients to choose goods according to their needs and desired characteristics. Our proficiency in digital tenders allows us to offer clients a unique opportunity to make a commercial decision remotely instead of a traditional visit to the office, providing them with all information required.

Bring a friend

On the heels of their successful May event, Alrosa launched another digital tender on June 3, offering more than 700 rough diamonds in the 5.00 to 10.00 carat range for sale. This time they opened the (virtual) doors to even more customers. Said Agureev:

The results of the digital tender’s first round show that demand for rough diamonds persists at the market, and our clients are ready to buy diamonds through the online channel. The tender format allows participants to bid basing on the reserve price. To the second round of the digital tender, we have additionally invited our spot and auctions partner companies. This is an important milestone in our efforts to extend sales channels and further digitalize trading and marketing.

Moves by other players

After a canceled 3rd Sight (tender) and a poorly attended 4th, DeBeers’ is currently holding Sight #5 in Botswana after working to enable customers who cannot travel to Botswana due to restrictions to view those goods in Antwerp, Hong Kong and Dubai and submit bids.

Meanwhile DeBeers’ Group Auctions has launched an online platform where registered buyers can make purchase rough diamonds online. According to Alastair Bickerstaff, Head of Product Development and Sales:

We are constantly seeking additional ways of meeting our customers’ needs in a fast-moving world, and we are excited to launch the Buy platform as it will provide an additional easy-to-access channel for our Registered Buyers to source what they want and when they want.

The global situation has stimulated similar evolution among other rough traders, introducing hybrid and fully remote tender opportunities for buyers.

International rough diamond brokerage I. Hennig has announced a “Virtual Broker” (VB) platform. Viewings will still take place in Antwerp, observing social-distancing guidelines, but VB sales events will allow suppliers and buyers to negotiate and close deals online at any given time without having to wait until the end of an event.

Koin International has launched “Virtual Viewer,” offering sessions where Koin experts act as the eyes and hands of clients in real-time using specialized equipment and technologies, including high-resolution video. Customers can view and review products at any time, since sessions are recorded, permitting bidding and buying from anywhere in the world.

Supply balancing

While creating outlets to sell existing stock, the miners are also working to offset a global slump in demand. DeBeers’ has placed many mines, from Africa to Canada to Russia, into ‘care and maintenance’ to halt production and stand down their workforce. Alrosa suspended production at their Aikhal underground, Zarya open-pit mine and Verkhne-Munskoye deposits and reduced output at Severalmaz. Both industry giants have indicated an overall 2020 supply reduction in double-digit percentages. In his 2020 “State of the Industry” webinar, Martin Rapaport speculated this reduction could approach 30% or greater.

All of these measures – stemming the flow of rough diamonds from the mines, coupled with the introduction of virtual/online sales of existing rough – are attempts to maintain equilibrium between supply and demand in the long term.